UBA Group

International Banking Conference 2022

About the Event

The UBA Group International Banking Conference 2022 aims to bring together banking and finance experts, along with representatives of sovereigns and development organisations, to discuss the challenges, opportunities, innovations, and solutions for correspondent banking innovations in a rapidly evolving international banking ecosystem

UBA's Global Positioning

70+

Years of Banking Excellence

4

Continents

24

Countries

1000+

Touch Points

Speakers

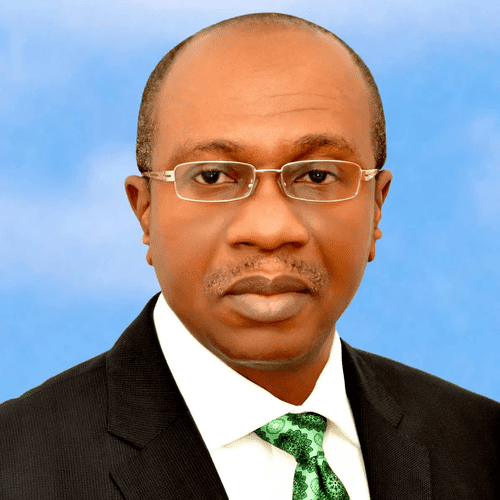

Governor Central Bank of Nigeria

Mr. Godwin Emefiele (CON)

Godwin Emefiele is the Governor of the Central Bank of Nigeria (CBN). Prior to his joining the CBN, he spent over 26 years in commercial banking culminating in his tenure as Group Managing Director and Chief Executive Officer of Zenith Bank PLC, one of Nigeria’s largest banks with over 7,000 staff, about US$3.2 billion in shareholders’ funds, and subsidiaries in Ghana, Sierra Leone, Gambia, South Africa, China, and the United Kingdom.

Under Emefiele’s leadership, Zenith Bank had strengthened its position as a leading financial institution in Africa, winning recognition and endorsement at home and abroad for giant strides in key performance areas like corporate governance, service delivery and deployment of cutting-edge ICT.

Before his banking career, he was a lecturer in Finance and Insurance in two Nigerian Universities. Mr. Emefiele holds degrees in Banking and Finance from the University of Nigeria, Nsukka, and is also an alumnus of Stanford University, Harvard and Wharton Graduate Schools of Business where he took courses in Negotiation, Service Excellence, Critical Thinking, Leading Change and Strategy.

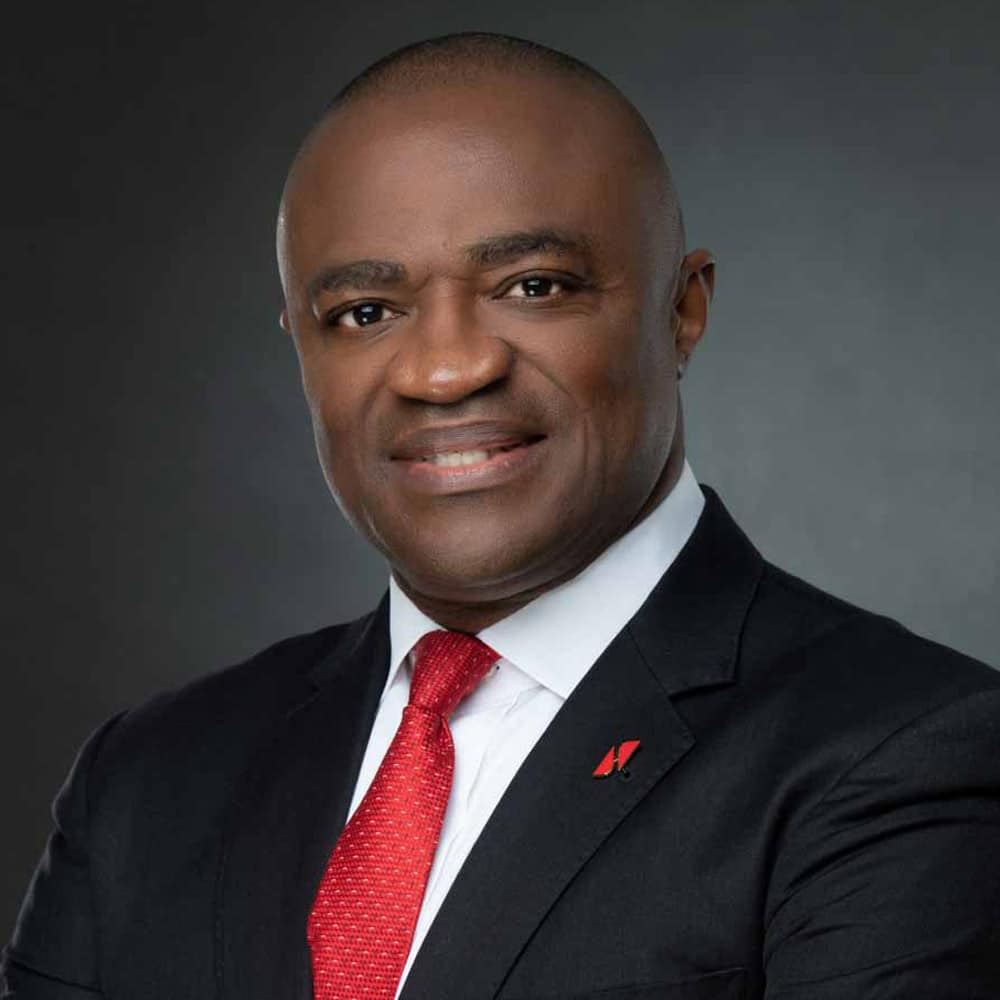

Group Managing Director/CEO

Oliver Alawuba

Oliver, a seasoned banking professional, comes on board with a broad range of strategic and well-grounded experience in Corporate and Institutional Banking, Consumer Banking, Public Sector, Retail and Commercial Banking, Project Management, Corporate Governance, and overall bank management.

Mr. Oliver Alawuba has acquired 25 years of work experience in the banking industry after his short foray into academia. He joined the former Standard Trust Bank (STB) as a pioneer staff in 1997. Over the years, he has demonstrated strong passion for excellence and result-oriented leadership capability.

Prior to his current appointment as the Group Managing Director/CEO of UBA Banking Group, Oliver was at various times country CEO and Regional CEO in the Rest of Africa, Executive Director, East Bank (Nigeria) and later Group Deputy Managing Director/CEO, covering Nigeria and other 19 subsidiaries in the Rest of Africa. He also worked in another bank and rose to the position of Executive Director. Oliver is an effective and self-motivated professional.

Oliver possesses B.Sc and M.Sc degrees in Food Science and Technology and MBA in Banking and Finance. He is an alumnus of the AMP and SEP programmes of the prestigious INSEAD Business School, France and London Business School respectively.

He is also a Fellow of the Nigerian Institute of Management (NIM) and an Honorary Senior Member of the Chartered Institute of Bankers of Nigeria (CIBN).

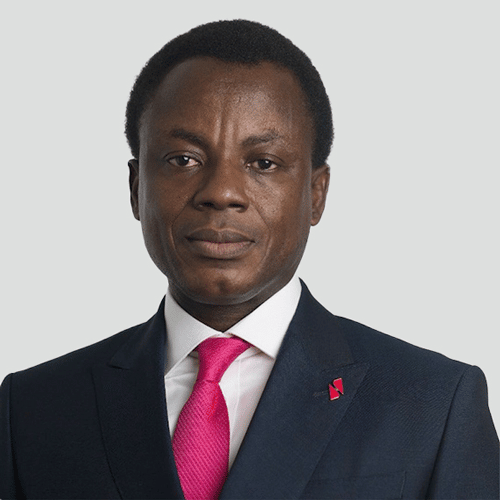

Executive Director UBA Group and CEO UBA America

Sola Yomi-Ajayi

Sola Yomi-Ajayi is a highly experienced banker with over 25 years of banking experience managing Corporate and Institutional relationships with significant experience in, Structured Lending, Transaction Banking, Risk Management, Financial Inclusion, Correspondent Banking, and Operations.

Currently the Chief Executive Officer (CEO) of UBA America with responsibility for growing the UBA franchise in the US, Sola is responsible for strategy formulation as well as oversight for various business groups at UBA such as Global Financial Institutions (GFI), Embassies, Multilateral, and Development Organizations (EMDO) as well as our Global Investor Services (GIS) teams. She leads the respective teams in the execution of corporate strategy and delivery of unique best-in-class financial solutions to UBA’s customers across these business segments.

Adesola has a Bachelor of Arts degree from Obafemi Awolowo University, Ile-Ife, Nigeria, and an MBA from the Aberdeen Business School. She has also attended leadership and executive programs at Harvard Business School and Judge Business School, University of Cambridge.

CEO, UBA UK

Adeleke Adeyemi

An experienced professional banker with over 22 years’ experience in the banking industry and varied experiences in audit, consulting, assets trading, treasury and balance sheet management, combined with exposure to enterprise risk management in Africa, North America and Europe.

Prior to his current role as the CEO of UBA (UK) Limited, he was at various times the MD/CEO (Designate) of UBA Kenya, Executive Director – Business Development of UBA (UK) Limited, and Head, Group ALM/Treasury Africa of UBA Plc with oversight responsibility for the Treasuries in the then 18 African subsidiaries of UBA Group.

CEO, UBA UAE

Vikrant Bhansali

Vikrant leads our business in Middle East & North Africa (MENA) region and is the CEO of United Bank for Africa Plc (DIFC Branch) in Dubai. He has had a distinguished banking career of over 25 years working in Sub-Saharan Africa, United Kingdom, MENA and India.

Prior to joining UBA, he worked for DIFC Authority (Government of Dubai), as Chief Representative – International Markets. His banking & financial markets career included roles as Regional Head of Institutional Sales, Sub Saharan Africa at Standard Chartered Bank, Prior to which he was Managing Director, at Société Générale in London where he was responsible for the bank MENA regional expansion strategy.

Vikrant has also held senior management positions with Morgan Stanley in London; Citigroup in London, Dubai and Bahrain; HSBC in India; and Arthur Andersen & Co. in India.

Vikrant holds an LLB, Bachelor of Law degree and is a Chartered Financial Analyst from the CFA Institute in USA. He also qualified as a Chartered Accountant from the Institute of Chartered Accountants of India, where he ranked 18th in the All-India Merit list. He is also empanelled as a consultant for IFC (World Bank Group) and serves on other Boards as an Independent Non-Executive Director

Deputy CEO, UBA America

Theresa Henshaw

Head of Business Development Theresa joined UBA UK in November 2020 as Head of Business Development from Crown Agents Bank UK, where she led the Global Markets Sales desk and Africa team. Prior to joining Crown Agents Bank, she spent 14 years at Habib Bank UK as Head of Treasury with executive oversight and responsibility for all Treasury activities in the UK, Switzerland, and Netherlands. Theresa is a specialist in Business Development, ALM, FX, Liquidity and Cash Management and Fixed Income. She is an alumnus of CASS Business School having studied MSc Finance & Investment; and runs a Mentor club for young, female professionals/entrepreneurs in the UK.

Non-Executive Director, UBA UK

Uche Ike

Mr. Ike is the Group Chief Risk Officer at UBA Plc. He is a Chartered Accountant, with an MBA from the University of Benin. He has been with the Group since 2006 and has served in a number of prominent roles, first as Group Head of Operations in South and South East Banks and then for a period of five years, as General Manager at the Bank’s New York branch.

Mr. Ike has over 27 years of banking experience.

Chief Risk Officer, UBA AMERICA

Ernest Dio

Ernest has been with UBA Group since 2004 and over the last 13 years, has served in different capacities at UBA America. Prior to his current role, he has served as Chief Operating Officer, Head of International Operations, and Head of Risk Management. He is a member of the Nigerian Chartered Institute of Bankers as well as the Association of Certified Anti Money Laundering Specialists.

DIRECTOR & GLOBAL HEAD TRADE FINANCE, AFREXIM BANK

Gwen Mwaba

Gwen Mwaba joined Afreximbank in May 2015 as Head of Anglophone West Africa region based in Abuja. She moved into her current role in 2016 as Director & Global Head, Trade Finance. She heads the Trade Finance business for Afreximbank and leads a team executing transactions in all Afreximbank member states across Africa.

Her expertise cuts across Corporate & Investment Banking, Leasing and in the last 15 years has specialised in Trade, covering Receivables Financing, Pre-export and Pre-payment financing, Structured Trade and Commodity Financing and lending to Financial Institutions and Sovereigns.

Gwen has 24 years of banking experience in Oil & Gas, Telecoms, Hospitality, Mining, manufacturing and agri-business.

Before joining Afreximbank, she worked for Standard Bank Plc in London.

Gwen is a Fellow of the Association of Chartered Certified Accountants (ACCA) and holds a BSc. Applied Accounting. She earned her MBA from Edinburgh Business School, Heriot-Watt University in 1997.

Financial Analyst, USDA

Miguel Parkins

Miguel Parkins is currently assigned to cover the Africa & Middle East Region (AME Region) for the GSM 102 and Facility Guarantee Programs. He covers both country risk and bank risk. Mr. Parkins received his B.A., in Economics from Syracuse University and his M.B.A. in Finance & Marketing at Pennsylvania State University. Mr. Parkins is a formally trained credit analyst with more than 10-years’ experience analyzing commercial loan transactions from a cash flow and asset-backed lending perspective.

Prior to joining the Federal Government, Mr. Parkins worked at IBM Global Finance as a Country Credit Manager for Venezuela and Colombia as well as a Technology Analyst. Mr. Parkins was raised in New York City.

Director, Financial Crimes, Promontory

Amir Ali

Amir has more than 12 years’ experience as a financial services practitioner, and provides expertise in risk management, strategic planning, regulatory relations, and compliance oversight. Amir has helped clients integrate and evolve their compliance programs by integrating technology into their compliance organizations to improve a broad range of compliance functions including risk assessments, improving transaction monitoring facilities and increasing operational efficiencies in Financial Intelligence Units in North America and Europe. Since joining Promontory, Amir has led a Transaction Monitoring program review for a subsidiary of a Canadian FI, following which he continued to provide assistance to implement the outcome of the review which included: conducting a coverage assessment across 17 jurisdictions, recommending a suite of TM rules in FiServ, and also reviewing 1st line/2nd line operational workflows for all Compliance related activities. In addition, Amir has led Client initiatives to establish technical capabilities within an organization to execute increasingly data driven risk assessments.

Prior to joining Promontory, Amir was a Director in the Global Investigations and Compliance Practice at Navigant Consulting, a boutique consultancy based in Chicago. While at Navigant Consulting, Amir was responsible for several large projects. He spent 18 months supporting the implementation of a Sanction platform (Actimize) with an MSB. Interacting with VP of Compliance, and CAMLO through the course of the engagement, he established a team to conduct the Sanctions Tuning, as well as develop an approach to vet the Internal Watchlist and devised an implementation approach to support their Go-Live. Amir also conducted a Sanctions System Selection RFP process for one of the largest Custodial Banks in the US. Interacting with both the French and US CAMLOs for a French bank, he led a team that conducted a review of the Sanctions program (Governance of watchlists, 1st/2nd/3rd Line Operational review in both Europe and the US), and then subsequently led management of their Sanctions Remediation program for a six months. For a New York Branch of a Canadian FI, Amir was responsible for taking over the management of multi-stream program to deliver a BSA Risk Assessment, KYC Process Review, and establish the parameters for a lookback. His team was then retained to establish a structure and monitor tracking of a multi-stream AML Remediation Plan. For the parent bank, Amir was responsible for running the Canadian practice while also being responsible for a multi-stream program that involved implementing a suite of rules and providing customizations for Oracle Mantas, conducting coverage assessments for multiple geographies in LatAm and establishing a managed service operation.

Derik Reische, Director, Regulatory and Finance Crimes Compliance, Exiger

Derik Riesche

Derik Riesche is based in Exiger’s New York office, where he oversees the Exiger’s internal and external training and development initiatives. Derik spent a majority of his time at Exiger focusing on Exiger Advisory's regulatory and Financial Crime Compliance (FCC) practice areas. He has advised clients on how to enhance their anti-money laundering and sanctions processes and controls. He has also worked extensively on independent financial crime compliance examinations and monitorships mandated by American and European regulators. Derik has led large teams in conducting assessments of financial institutions’ trade finance, AML and sanctions compliance programs across the North America, South America, Europe, Asia, and Africa.

Derik joined Exiger from UBS, where he was the Regional Head of FCC training. While there, he was responsible for development and delivery of FCC training programs for the company’s various lines of business in the Americas and for the Investment Bank, globally. He was also part of the FCC Investigations department as well as the FCC Policy department managing special projects concerning regulatory examinations of the UBS Americas FCC program.

Head, Regulatory Compliance, UBA America

Charles Constantin

About UBA America

Why You Should Attend

- Learn about new innovations in banking

- Network with banking and finance experts

- One on one interactions with key stakeholders in the banking industry

- Explore UBA solutions to international banking operations

Agenda Summary

Day 1 – Arrival and Registration

Day 2 – Compliance Across the International Banking World

Day 3 – Cross-Border Payments Challenges and Correspondent Banking in the International Banking Environment

Day 4 – Global Financial Markets and Treasury Solutions